In Arkansas they took an ax, and gave the tax rate another whack; the governor said after this latest one, she’ll keep cutting until the taxing is done.

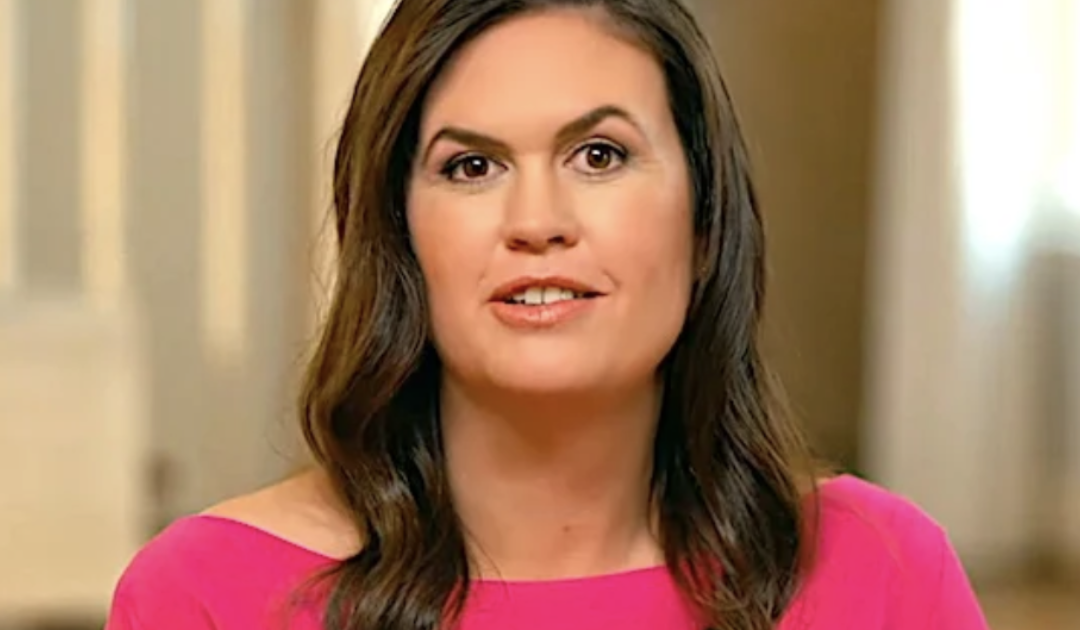

Republican Gov. Sarah Huckabee Sanders on Wednesday signed bills cutting the individual and corporate tax rates while raising the homestead property tax credit, according to the Associated Press.

Sanders has cut taxes three times since she took office in January 2023, and said her goal is to wipe away the state income tax altogether.

“We are moving in the right direction and we’re doing so responsibly,” Sanders said.

We returned half a billion to Arkansans today, lowering our income tax to 3.9%.

Since taking office last year we have cut income taxes three times, and of the Southern states with an income tax, Arkansas now has the lowest. pic.twitter.com/P7pBH5qohs

— Sarah Huckabee Sanders (@SarahHuckabee) June 19, 2024

The new rates, retroactive to Jan. 1, reduce the top individual tax rate from 4.4 percent to 3.9 percent. The top corporate rate will drop from 4.8 percent to 4.3 percent, retroactively, beginning Jan. 1.

By contrast, according to taxfoundation.org, the top tax rate for individuals in New York state is 10.9 percent, with a top rate for corporations of 7.25 percent.

Sanders explained her tax-cutting logic in an Op-Ed on Fox News.

“Who do you trust to handle your money: the government or yourself? Personally, I think you handle your money better than politicians ever could. That’s why I entered office promising to responsibly phase out our state income tax,” she wrote.

She said that collectively, about 1.1 million state residents, the “majority of taxpayers,” will save “nearly half a billion dollars.”

BREAKING: Arkansas Governor Sarah Sanders reportedly plans to get rid of the state income tax very soon. This comes as she just signed a bill into law significantly reducing property and income taxes. pic.twitter.com/75mQS1cEY2

— Jesse Morgan (@Jesse_Morgan_) June 21, 2024

“Democrats in Washington drove our economy off the rails, making sound stewardship in Little Rock even more important,” she said, noting that curbing spending has led to curbing taxes and adding, “With extra money in their pockets, Arkansans have more ability to cover the higher cost of everyday items.”

Sanders said state residents need all the help they can get to cope with the high cost of living imposed by the Biden administration.

“Prices are up 20 percent since President Biden took office and lit trillions of taxpayer dollars on fire, causing an inflationary spiral we haven’t seen since Jimmy Carter was president,” she wrote.

“The average Arkansas family has to pay nearly $800 more a month to make the same purchases they were making when Joe Biden took his oath of office. Eggs cost nearly twice as much, chicken prices have gone up over 25 percent and bread is 30 percent more expensive,” she wrote.

Sanders said her state is “at a crossroads.”

“On the one hand, thanks to our pro-growth policies, more Arkansans are working than ever before, our population and economy are growing, and the credit rating agency S&P just upgraded Arkansas’ outlook from ‘stable’ to ‘positive’ — one of only six states to receive that rating. On the other hand, families and businesses alike are facing headwinds from Washington’s economic mismanagement,” she wrote.

Sanders said what can be done in Arkansas can be done across America.

“Polls show that Americans are fed up with Democrats in Washington. After three years of economic failure, that’s not surprising. The good news is there’s another option: fiscal responsibility, smaller government and lower taxes. It’s working in Arkansas. It’s working in other Republican-led states. And if it’s put in place in Washington, it will revive our national economy,” she wrote.

This article appeared originally on The Western Journal.

The post Governor Announces Efforts Underway to End State Income Tax appeared first on The Gateway Pundit.